Breadcrumb

Blogs

Entries with tag soy .

The constant expansion of soy production within the MERCOSUR countries exceeds 50% of total world production

While many typically associate South American commodities with hydrocarbons and minerals, soy or soybean is the other great commodity of the region. Today, soy is the agricultural product with the highest commercial growth rate in the world. China and India lead world consumption of this oleaginous plant and its byproducts, thus making South America a strategic supplier. Soy profitability has encouraged the expansion of crop production, especially in Brazil and Argentina, as well as in Paraguay, Bolivia and Uruguay. However, such expansion comes at an environmental cost; such as recent deforestation in the Amazon and the Gran Chaco.

ARTICLE / Daniel Andrés Llonch [Spanish version]

Soy has been cultivated in Asian civilizations for thousands of years; today its cultivation is also widespread in other parts of the world. It has become the most important oilseed for human consumption and animal feed. Of great nutritional properties, due to its high protein content, soybeans are sold both in grain and in their oil and flour derivatives.

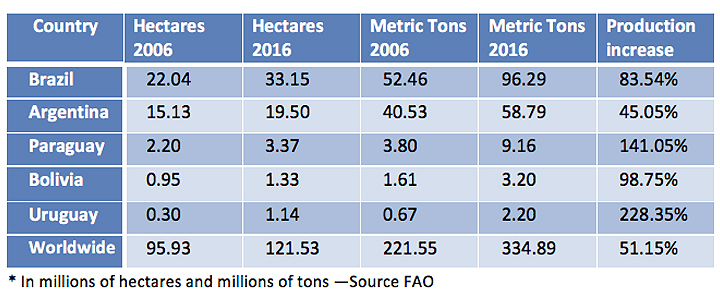

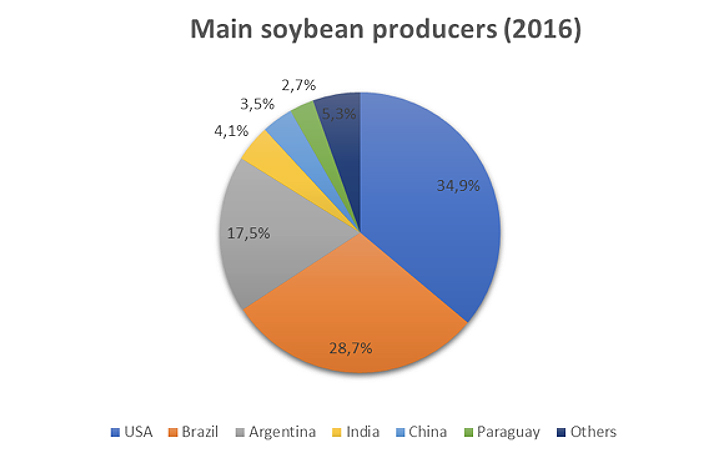

Among the eleven largest soybean producers, five are in South America: Brazil, Argentina, Paraguay, Bolivia and Uruguay. In 2016, these countries were the origin of 50.6% of world production, whose total reached 334.8 million tons, according to FAO data. The first producer was the United States (34.9% of world production), followed by Brazil (28.7%) and Argentina (17.5%). India and China follow the list, although what is significant about this last country is its large consumption, which in 2016 forced it to import 83.2 million tons. Much of these import needs are covered from South America. Furthermore, the South American production focuses on the Mercosur nations (in addition to Brazil and Argentina, also Paraguay and Uruguay) and Bolivia.

The strong international demand and the high relative profitability of soybean in recent years has fueled the expansion of the cultivation of this plant in the Mercosur region. The price boom for raw materials, which also involved soy, led to benefits that were directed to the acquisition of new land and equipment, which allowed producers to increase their scale and efficiency.

In Argentina, Bolivia, Brazil and Paraguay the area planted with soybeans represents the majority (it constitutes more than 50% of the total area sown with the five most important crops in each country). If we add Uruguay, where soybean has enjoyed a later expansion, we have that the production of these five South American countries has gone from 99 million tons in 2006 to 169.7 million in 2016, which constitutes a rise of 71%. , 2% (Brazil and Bolivia have almost doubled their production, somewhat exceeded by Paraguay and Uruguay, where it has tripled). In the decade, this South American area has gone from contributing 44.7% of world production to 50.6%. At that time, the cultivated area increased from 40.6 million hectares to 58.4 million.

|

Countries

As the second largest producer of soybeans in the world, Brazil reached 96.2 million tons in 2016 (28.7% of the world total), with a cultivation area of 33.1 million hectares. Its production has been in a constant increasement, so that in the last decade the volume of the harvest has increased by 83.5%. The jump has been especially notable in the last four years, in which Brazil and Argentina have experienced the highest growth rate of the crop, with an annual average of 936,000 and 878,000 hectares, respectively, according to the United States Department of Agriculture. (USDA).

Argentina is the second largest producer of Mercosur, with 58.7 million tons (17.5% of world production) and a cultivated area of 19.5 million hectares. Soybeans began to be planted in Argentina in the mid-70s, and in less than 40 years it has had an unprecedented advance. This crop occupies 63% of the areas of the country planted with the five most important crops, compared to 28% of the area occupied by corn and wheat.

Paraguay, for its part, had a harvest of 9.1 million tons of soybeans in 2016 (2.7% of world production). In recent seasons, soy production has increased as more land is allocated for cultivation. According to the USDA, in the last two decades, the land dedicated to the cultivation of soybeans has constantly increased by 6% annually. Paraguay currently has 3.3 million hectares of land dedicated to this activity, which constitutes 66% of the land used for the main crops.

As far as Bolivia is concerned, soybeans are grown mainly in the Santa Cruz region. According to the USDA, it represents 3% of the country's Gross Domestic Product, and employs 45,000 workers directly. In 2016, the country harvested 3.2 million tons (0.9% of world production), in an area of 1.3 million hectares

Soybean plantations occupy more than 60 percent of Uruguay's arable land, where soybean production has been increasing in recent years. In fact, it is the country where production has grown the most in relative terms in the last decade (67.7%), reaching 2.2 million tons in 2016 and a cultivated area of 1.1 million hectares.

|

Increase of the demand

The production of soy represents a very important fraction in the agricultural GDP of the South American nations. The five countries mentioned together with the United States make up 85.6% of global production, so they are the main suppliers of the growing global demand.

This production has experienced a progressive increase since its insertion in the market, with the exception of Uruguay, whose product expansion has been more recent. In the period between 1980 and 2005, for example, the total world demand for soybean expanded by 174.3 million tons, or what is the same, 2.8 times. In this period, the growth rate of global demand accelerated, from 3% annually in the 1980s to 5.6% annually in the last decade.

In all the South American countries mentioned, the cultivation of soy has been especially encouraged, because of the benefits that it entails. Thus, in Brazil, the largest regional producer of oilseed, soybean provides an estimated income of 10,000 million dollars in exports, representing 14% of the total products marketed by the country. In Argentina, soybean cultivation went from representing 10.6% of agricultural production in 1980/81 to more than 50% in 2012/2013, generating significant economic benefits.

The outlook for growth in demand suggests a continuation of the increase in production. The United Nations Food and Agriculture Organization estimates that global production will exceed 500 million tons in 2050, which doubles the volume harvested in 2010 and clearly, much of that demand will have to be met from South America.