Breadcrumb

Blogs

Entries with tag commodities .

Cyclical movements in the Latin American economy show close links to fluctuations in mineral pricing

The attention of public opinion on the price of commodities usually focuses on hydrocarbons, especially oil, because of the direct consequences on consumers. But although there are important oil producers in Latin America, minerals are a more transversal asset in the region's economy, especially in South America. This is shown by the largely parallel lines that follow the evolution of non-energy minerals and GDP growth, both in times of boom and of decline.

ARTICLE / Ignacio Urbasos Arbeloa [Spanish version]

Mining activity is a fundamental sector for most of the Latin American economies. The sector has a huge weight on exports and the attraction of foreign direct investment making it one of the most important sources of international currencies. Against the general perception of the non-energetic mining activities as a mature industry, the sector has demonstrated its capability to be attractive for investment and able to produce jobs and wealth. Latin American mining is the destiny of 30% of world investment in the sector, which is waiting for a rising in prices. The effect of these price fluctuations have direct consequences on the economies of the continent, being some of them deeply dependant on the exploitation and sell of its natural resources. The main goal of this analysis is to articulate a convincing explanation of the impact of price fluctuation on non-energetic minerals on national GDPs.

Firstly, it is important to explain the chronological evolution of prices in the most exploited minerals of Latin America. The general tendency of commodity prices during the last two decades has been marked by a great volatility. The so called super cycle of commodities [1] produced between 2003 and 2013, with recoil during 2008 and 2009, coincides with the golden decade of Latin America. This situation was produced thanks to an unprecedented rising of global demand, mainly of the emerging countries leaded by China. In fact, the rising of China has transformed the trade pattern in the region which is today the main trade partner of a large number of countries.

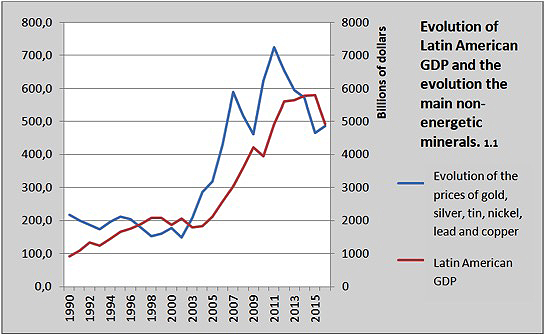

The mentioned evolution in commodity prices is similar to the one of the non-energetic minerals, which generally follows the tendencies of raw materials. As graph 1.1 shows, the region of Latin America and Caribbean has growth in correlation to the average evolution of the prices of gold, silver, tin, nickel, lead and copper. It is important to mention that this correlation in not an isolated one, and has to be analyzed in the context of a general rising in natural resource-based products such as hydrocarbons and agricultural goods.

|

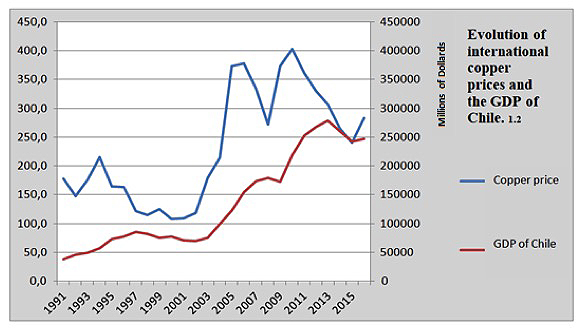

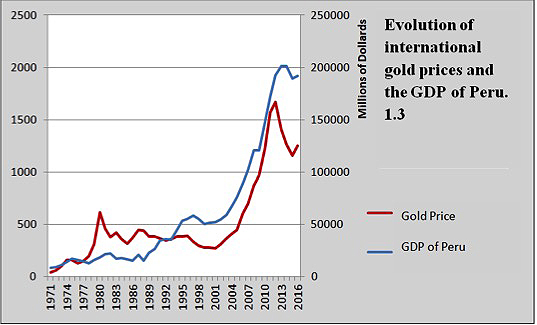

[The graphics have been made from World Bank Data and national statistics of Peru and Chile] |

The Chilean case can be illustrative. The country has an economy particularly specialized on non-energetic minerals, outstanding copper as a core mineral for the country. Chile is the main producer of copper in the world and this mineral is around 50% of the national exports. The mining sector in Chile [2] represented the 20% of the country's GDP during the 2000’s, in 2017 it is only 9% of its economy. In graph 1.2 it is evident how the economic growth of Chile is directly linked with the different prices of copper. Even though it is one of the most complex and developed economies in the continent, with a tertiary sector [3] representing the 74% of its GDP, Chilean economy is still dependant and affected by copper prices and the situation of the mining industry.

|

|

Another interesting case is the Peruvian one, a country whose exports are in a big proportion composed by non-energetic minerals. Gold is 18% and copper is 26% of all exports [4], reaching both more than 46% of them. Similarly to the case of Chile, 15% of its national GDP comes from the mining activities. Again, the correlation of mineral prices and economic growth is evident in graph 1.3, showing the huge dependence of these economies to the international prices of their exports.

|

|

This relationship is logical and has its answer in different realities. On the one hand, the quantitative value of natural resources on the Latin American economies, whose exports are mainly composed by mineral, agricultural or energetic commodities. On the other hand, the qualitative importance of the mining sector, which creates huge amounts of employs (up to 9% of the total in Chile), is the activity of some of the main companies in the region (among the 20 biggest companies in the Latin America, 5 are related to the mining activities), it is the main source of currencies and support public budgets by its particular fiscal regime. Equally, a big amount of national public debts are covered by those particular taxes, creating a situation of possible default in case of great fluctuations of prices. This menace brings back the memories of the debt crisis in the 80’s, something that it is now a reality in the case of Venezuela.

Must be taken into account that Latin American countries are not a unicity or a homogeneous reality, in general it is true that the region confronts a general challenge: be able of reduce the dependence of their economies to the exploitation and sell of its natural resources. An economic structure that is problematic because of its impact on the environment, a particular complex issue because of the resistance of indigenous groups to suffer from it. The nature of the employs created by this activity is sometimes disappointing, with low wages and bad labor conditions. Anyway, the industrial development of the region is still far from being sufficient and there is a rising awareness about the lack of economic structural reforms during the golden decade of 2003-2013 that could have changed the situation [5]. The profits derived from the mining sector are used to promote political interest or short-term goals with electoral sights.

This inefficient use of the public resources increases the vulnerability of the general welfare to the mentioned continuous shifts in prices. Even though perspectives about prices are optimistic and expect an imminent rise [6], they will not reach the levels of 2008, when they were at its historical maximum. This new context will demand a new approach to Latin American economies, which will not have access to the huge amount of money that they had during the past decade. Its economic growth will not come from an external favorable context, but from internal efforts to modernize and renovate its economic capability.