Breadcrumb

Blogs

Entries with tag nafta .

Las consecuencias positivas del acuerdo de libre comercio se derivarán más del fin de la incertidumbre que de las nuevas disposiciones introducidas

Tras un año y medio de negociaciones, el nuevo Tratado de Estados Unidos, Canadá y México (este país lo ha bautizado como T-MEC, los otros dos hablan de USMCA) está aún pendiente de aprobación por las cámaras legislativas de cada país. En Washington el debate político debiera comenzar en breve; en él tendrá importancia qué efectos se prevé para la economía de EEUU y la de sus dos vecinos. Los primeros estudios discrepan en algunos aspectos, si bien coinciden en que los cambios introducidos en la renegociación del acuerdo que existía desde 1994 no van a tener especial impacto.

![Firma del tratado de libre comercio entre EEUU, México y Canadá, en el marco del G-20, en noviembre de 2018 [Shealah Craighead-Casa Blanca] Firma del tratado de libre comercio entre EEUU, México y Canadá, en el marco del G-20, en noviembre de 2018 [Shealah Craighead-Casa Blanca]](/documents/10174/16849987/tmec-blog.jpg)

▲ Firma del tratado de libre comercio entre EEUU, México y Canadá, en el marco del G-20, en noviembre de 2018 [Shealah Craighead-Casa Blanca]

ARTÍCULO / Ramón Barba

La renegociación del antes llamado Tratado de Libre Comercio de América del Norte (TCLAN, o NAFTA por su siglas en inglés) y ahora bautizado como Tratado de Estados Unidos, México y Canadá (T-MEC o, en su versión anglosajona, USMCA), ha sido uno de los principales puntos en la agenda de la Administración Trump. Aprobado por las tres partes negociadoras a finales de 2018, ahora el tratado está pendiente de ser ratificado por las cámaras legislativas de cada país.

Puesto en marcha en 1994, el acuerdo había sido calificado por Trump como “el peor tratado comercial de la historia”. Desde el comienzo de su presidencia, Trump se propuso modificar algunos aspectos del acuerdo para reducir el gran déficit comercial con México (unos 80.000 millones de dólares, el doble del déficit que EEUU tiene con Canadá), y al tiempo devolver actividad y empleos al Rust Belt estadounidense, donde el eco de sus promesas había sido decisivo para su victoria electoral.

¿Qué ha ganado y qué ha perdido cada país en la renegociación del tratado? Y, sobre todo, ¿qué efectos va a tener en la economía de cada país? ¿mejorará Estados Unidos su balanza comercial? ¿se verán afectados negativamente México o Canadá por algunas modificaciones introducidas? Primero examinaremos cómo quedaron las pretensiones de cada uno de los socios al término de las negociaciones, y luego veremos el posible efecto económico de la nueva versión del tratado a la luz de dos recientes estudios, uno de un órgano independiente de la Administración estadounidense y otro elaborado por el FMI.

Tira y afloja

En las negociaciones, que se alargaron durante casi año y medio, México y Canadá lograron “mantener el status quo en muchas áreas importantes”, pero si bien los cambios reales fueron modestos, según se analizó desde Brookings Institution, estos “fueron casi uniformemente en la dirección de lo que quería Estados Unidos”. “El enfoque agresivo y amenazador de Trump”, que desafió con romper definitivamente el tratado, “logró obtener concesiones modestas de sus socios”.

En el punto clave de la industria automotriz, EEUU consiguió aumentar del 62,5% al 75% la proporción de la producción de un automóvil que debe hacerse dentro del área de libre comercio, obligar a que el 30% del trabajo necesario para fabricar un coche tenga un salario de 16 dólares/hora (el 40% a partir de 2023) –una medida dirigida a apaciguar a los sindicatos estadounidenses, pues en México el sueldo medio de un trabajador de la automoción es hoy de 4 dólares/hora–, y fijar un arancel del 25% para los coches llegados de fuera.

México y Canadá vieron atendida su demanda de que no introducir una cláusula de terminación autonómica a los cinco años si no había consenso previo para la renovación del acuerdo, puesta sobre la mesa por Washington. Finalmente, el T-MEC tendrá una duración de 16 años, renovable, con una revisión al sexto año.

El Gobierno de Justin Trudeau tuvo que hacer algunas cesiones ante el sector lácteo estadounidense, pero preservó lo que desde el comienzo había sido su principal línea roja: la vigencia del capítulo 19, referente a la solución de controversias mediante un arbitraje binacional independiente.

México, por su parte, ganó la tranquilidad que supone la pervivencia del tratado, evitando incertidumbre futura y garantizando la estrecha relación comercial con el gran mercado estadounidense. No obstante, las condiciones laborales de los trabajadores mexicanos puede funcionar como un arma de doble filo para la economía azteca, pues por un lado puede favorecer una mejora del nivel de vida e incentivar el consumo, pero por otro puede afectar a la localización de empresas debido a unos salarios menos competitivos.

Al margen de estos cambios en una u otra dirección, la actualización del tratado era necesaria tras 25 años de un acuerdo que se firmó antes de la revolución de internet y de la economía digital que esta ha traído. Por otra pare, el cambio de denominación del tratado fue una “triquiñuela” ideada por Trump para vender a su electorado la renovación de un acuerdo cuyo nombre anterior iba asociado a críticas vertidas en las dos últimas décadas.

El debate sobre el texto se desarrollará en otoño en el Congreso estadounidense, donde los demócratas insistirán en reforzar las garantías de que México aplicará las medidas laborales comprometidas. Antes del voto EEUU deberá aplicar un exención a Canadá y México de los aranceles sobre el acero y el aluminio que la Administración Trump ha impuesto internacionalmente.

|

Efecto económico

La Comisión de Comercio Internacional de Estados Unidos (USITC), órgano independiente que tiene el estatus próximo al de una agencia gubernamental, considera que el T-MEC tendrá un impacto limitado, pero positivo para la economía estadounidense. Así, en un informe publicado en abril, estima que la entrada en vigor del reformulado acuerdo hará aumentar la producción de EEUU en un 0,35%, con un incremento del empleo del 0,12%, cifras algo menores de las previstas cuando el TLCAN entró en vigor en 1994, momento en que EEUU esperaba un aumento del 0,5% de su economía y una subida del 1% del empleo.

En cualquier caso, ese tímido impacto no sería tanto por el contenido del texto acordado, sino por su mera existencia, ya que elimina incertidumbres sobre las relaciones comerciales de EEUU con sus dos vecinos.

El informe cree que el T-MEC supondrá un incremento de la producción de accesorios de automóvil en EEUU, arrastrando hacia arriba el empleo en ese país, pero provocando un encarecimiento de los productos y, por tanto, afectando negativamente la exportación. El informe prevé también que el mantenimiento del actual el sistema de arbitraje, como exigían México y Canadá, desanimará inversiones estadounidenses en el mercado mexicano y las potenciará en EEUU.

Esas conclusiones no coinciden con la apreciación del Fondo Monetario Internacional, si bien ambas instancias están de acuerdo en descartar efectos mayores del acuerdo. Así, un estudio del FMI publicado en marzo cree difícil afirma que, en el nivel agregado, los efectos del nuevo redactado “son relativamente pequeños”. Las nuevas provisiones “podrían llevar a una menor integración económica de Norteamérica, reduciendo el comercio entre los tres socios norteamericanos en más de 4.000 millones de dólares (0,4%), al tiempo que otorgando a sus miembros unas ganancias conjuntas de 538 millones de dólares”. Añade que los efectos en el PIB real del área de libre comercio son “insignificantes”, y matiza que muchos de los beneficios “vendrían de las medidas de facilitación comercial que modernizan e integran procedimientos aduaneros para reducir aún más los costes de comercio y las ineficiencias fronterizas”.

El resultado del estudio muestra que las más exigentes normas de origen en el sector de la automoción y los requerimientos de contenido de valor laboral, asuntos que atañen especialmente a la relación EEUU-México, “no conseguirían sus deseadas consecuencias”. Según el FMI, “las nuevas reglas llevan a un declive en la producción de vehículos y partes en los tres países norteamericanos, con giros hacia mayor abastecimiento de vehículos y partes de fuera de la región. Los consumidores encontrarán precios de vehículos más altos y responderán con una demanda de menor cantidad”.

En cuanto al mercado lácteo de Canadá, cuestión de especial relevancia en la relación comercial entre ese país y EEUU, los efectos de un mayor acceso estadounidense “serían muy pequeños y macroeconómicamente insignificantes”.

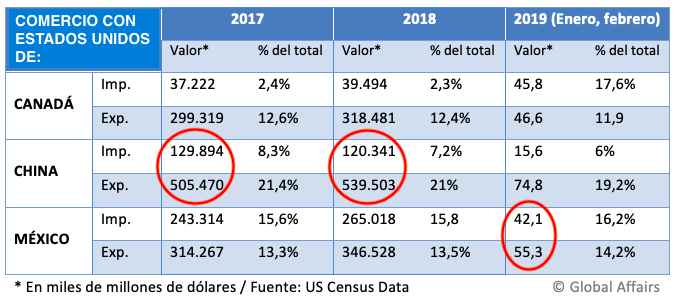

Esta disparidad de previsiones entre la USITC y el FMI obedece a que diversas variables están indeterminadas, como el futuro del acuerdo transpacífico, en el que están Canadá y México, o las discusiones comerciales en curso entre EEUU y China. Una muestra en que el terreno es especialmente movedizo es el dato de que en enero y febrero de 2019 México pasó a ser el primer socio comercial de EEUU (un intercambio de 97.400 millones de dólares), por delante de Canadá (92.400 millones) y China (90.400 millones). Eso elevó en 3.000 millones de dólares el déficit comercial de EEUU con México, justo en la dirección opuesta de las pretensiones de la Administración Trump.

▲Presidents Enrique Peña Nieto and Donald Trump, in the latest G20 Summit; Hamburg, July 2017 [Presidency of México]

ANALYSIS / Dania Del Carmen Hernández [Spanish version]

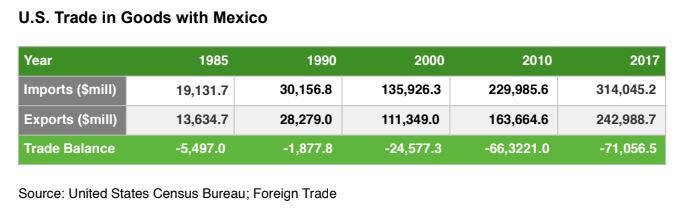

Canada, the United States and Mexico find themselves immerse in the renegotiation of the North American Free Trade Agreement (NAFTA). The trade treaty between these three countries has been controversial in the past few years, especially in the US, where many have doubted its benefits. During the presidential campaign, Donald Trump defended the complete elimination of the treaty; subsequently, when already in the White House, he agreed to make the renegotiation happen. President Trump argues that the pact has hollowed out US manufacturing and caused a trade deficit of over $60 billion with Mexico ($18 billion with Canada), so unless he can rework it in favor of the United States, he said, he won’t hesitate to withdraw from it.

Overall, the American people have pretty positive views on the treaty, with 56% of the population who say that NAFTA is beneficial to the country, and just a 33% who say it’s bad, according to a poll conducted by Pew Research in November 2017. Out of those who have a negative view, the majority are Republicans with 53% of them claiming Mexico benefits more, compared to Democrats who are generally more supporting of the trade pact and with just 16% who agree with the Republicans on that matter.

|

Regardless of public acceptance, opinion on the treaty hasn’t always been so dubious. When President Bill Clinton signed it into law, it was actually considered one of the first successes in his presidency. The same way globalization has liberalized trade all over the world, NAFTA effectively expanded trade and presented a great number of opportunities for the US, all while strengthening the country's economy.

Under NAFTA, US trade in goods and services with Canada and Mexico went from $337 billion in 1994 when the treaty came into force, to about $1.4 trillion in 2016. Under NAFTA, cross-border investment among the three member countries has surged as well, from $126.8 billion in 1993 to $731.3 billion in 2016.

The concern in Washington is that, despite of the increasing volume of trade, in relative terms the US isn’t getting fruitful enough results, compared to what its neighbors are getting from it. In any case, Canada and Mexico accept that, almost after 25 years of validity, the agreement must be revised to be able to adapt it to the new productive and commercial conditions, defined by technological innovations that, as is with the case of the development of the internet, weren’t contemplated when the treaty was signed.

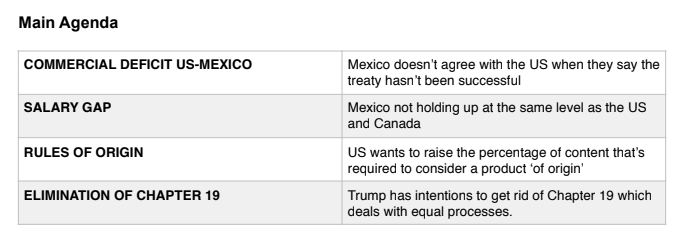

Round to round examination

The discussion between the three countries affects numerous aspects, but we can talk about three main blocks that have to do with certain red lines set by the different parts in the negotiation: rules of origin; the desire of the United States to end the independent system of arbitration, through which Canada and Mexico can terminate the measures that might violate the treaty (elimination of Chapter 19), and finally other proposals, perhaps less decisive but equally important, oriented towards the general wish to update the agreement.

When the negotiations started, in August 2017, the countries expressed a concern to reach a final decision in January 2018. The plan was to have six rounds of meetings. That number has been already overcome: a seventh round is happening at the end of February and there will be possibly more. As we have reached the initial deadline an examination on the state of the discussion is relevant. A good way of doing it is following the evolution of the conversations through the rounds of meetings celebrated and this way we can evaluate the results that have been registered so far.

|

Latest North America Summit, with Presidents Peña Nieto and Obama, and Prime Minister Trudeau; Canada, June 2016 [Presidency of México] |

1st Round (Washington D.C.; August 16-20, 2017)

The first round of negotiations set the priorities for each one of the three countries on the table; it served to fixate the agenda of the principal issues that would be discussed later on, without going into much detail about the measures and the how- to’s.

In the first place, Donald Trump had already set clear during his campaign that he considered NAFTA an unjust agreement for the United States, due to the commercial deficit that the country has mostly with Mexico, and to a lesser extent, with Canada. According to the Office of the United States Trade Representative (USTR), the US went from a surplus of $1.3 billion in 1994 to a deficit of $64 billion in 2016. The major part of this deficit comes from the automotive industry. For the new administration, this puts in doubt that the treaty may have beneficial effects on American economy. Mexico, less predisposed to introduce important changes, insists that NAFTA has been good for all parties involved.

Another topic that was noted was Mexico’s salary gap against the US and Canada. Mexico defends that, despite having one of the lowest minimum wages in South America, and having had their medium wage stuck during the two past decades, this shouldn't be taken into account in the negotiations, for it is estimates that Mexican salaries will eventually reach those of their commercial partners. On the contrary, for the US and Canada, this remains a matter of concern; both countries insist that a wage increase would not damage Mexican economy.

Rules of origin was one of the principal recurring topics of discussion. The United States is looking for augmentation in the percentage of content that is required to consider a product as of origin so that it won’t be necessary to pay tariffs when moving it between the three countries. This proved to be rather controversial in this first round, as it could negatively affect Mexican and Canadian companies. Specialists have made the remark that a minimum of national content does not exist in any free trade treaties in the world.

Lastly, Trump’s administration let their intentions of eliminating Chapter 19 show. A section of the treaty which guarantees equality in the solving of disputes between the countries, making it so that it isn’t national laws what will dictate the outcome. The US understands it as a threat to their sovereignty and believes that conflicts should be resolved in a way in which their own democratic processes wont be ignored or jeopardized. For their part, Canada conditioned their permanence in the treaty with the maintenance of the chapter. Mexico also defends guarantees of independence in the resolution of conflicts even though for the moment it hasn't been categorical in this discussion, since it lingers on the side, and will act accordingly to what results most favorable.

|

2nd Round (Mexico City; September 1-5, 2017)

Although considered successful by many analysts, the second round of the renegotiation followed a very slow pace. Some of the matters that made advances were: salaries, access to markets, investment, rules of origin, commercial facilitation, environmental issues, digital commerce, SME’s, transparency, anti- corruption laws, agronomy and textiles.

The president of Corporate Coordinating Council in Mexico, Juan Pablo Castañon, insisted that for now the salary issue wasn't up for negotiation, and rejected the idea that any of the parties had the intention of pulling out of the treaty, despite the previous threats from the Trump administration. Castañon rallied in favor of Mexico supporting the maintenance of Chapter 19 or the establishment of a similar instrument with the purpose of solving commercial controversies amid the three countries.

3rd Round (Ottawa; September 23-27, 2017)

The delegates made important advances in competition policies, digital commerce, state-owned companies and telecommunications. The principal development had to do with some aspects related to SME’s.

The Canadian chancellor, Chrystia Freeland, criticized that the United States had not made any written formal proposals on the most complex areas, demonstrating a passive attitude of the country in the context of the negotiation.

The US trade official, Robert Lighthizer, said that his country is interested in incrementing the salaries in Mexico to avoid an unfair competence, seeing that Mexico has attracted factories and investments with their low salaries and their weak trade-union regulations.

Canada endured a firm posture on Chapter 19, which they consider one of the greatest achievements of the current agreement. “Our government is absolutely committed to defending it”, said Freeland. Washington requested, though without presenting a formal proposition, the modification of the rules of origin so that they are more strict, avoiding that imports from other nations are considered “made in North America”, just because they were assembled in Mexico.

This round took place while the United States fixated a tariff of almost 220% to the CSeries aircrafts by the Canadian manufacturer Bombardier, after considering that the enterprise had used a governmental subsidy to sell its planes to the United States at artificially low prices.

4th Round (Virginia; October 11-17, 2017)

The United States presented their formal proposal of elevating the rules of origin in the automobile industry and suggested introducing a termination clause in the treaty.

The US proposed elevating the percentage of components of national origin from any of the three countries from 62,5% to 85% so that the production in the automobile industry can benefit from NAFTA. This way 50% of it will be American production.

It was also debated, in the interest of Washington, the debilitation of the system of controversy resolution present in Chapter 19, which was done without registering an approximation of the positions.

To finish, they talked about a termination clause that would give the treaty five years of life and once that time was over, it would automatically disappear, unless, when the time came, the countries decided to renovate it. This proposal received several critiques, many claiming that this could infringe the essence of the agreement and that every five years would generate uncertainty in the region, considering that it would affect the investment plans of companies.

These proposals just sum to the harsh climax of the negotiation that had been present since the last round in which the US had started to defend difficult proposals like the trials for dumping (selling a product for a price below its normal price) in the imports of perishable Mexican products (tomatoes and berries, governmental and textile purchases.

5th Round (Mexico City; November 17-21, 2017)

|

The fifth round didn't show too many advances. The United States kept their requests and that generated frustration amongst the representatives of Mexico and Canada.

The US didn't receive alternatives to their proposal to change the regional composition from a 62,5% to an 85%, and that at least 50% is American, On the contrary, its commercial partners showed the damage that this proposal could cause to the three economies.

Faced with the US’ intentions to limit the number of concessions that their federal government offers to Mexican and Canadian enterprises, Mexican negotiators responded with a proposal to limit the country’s public contracts to the number of the contracts attained by Mexican companies with other governments inside the NAFTA. Given that the number of those contracts is significantly reduced, US companies will see their contracting being restricted.

Upon completion of this fifth round, the topics that are now more developed are the ones that involve a regulatory enhancement of telecommunications and the chapter on sanitary and phytosanitary measures. With this last thing, Americans are looking to establish new transparent and non discriminatory norms, that will allow each country to establish the degree of protection they find appropriate.

6th Round (Montreal; January 23-29, 2018)

The Sixth Negotiation Round saw some progress. The chapter on corruption was finally closed, and progress was made in other fields. More importantly, we finally saw a discussion that involved some of the core issues that had been pushed back in the previous negotiations. The progression is slow, but steady.

Robert Lightizer rejected the compromise on rules of origin that Canada had previously proposed. The structure was based on the idea that the rules of origin should be calculated to also include the value of software, engineering and other high-value work, which is currently not counted toward the regional content targets. This would guarantee the safeguarding of high-paying jobs in the area. The US expressed its disapproval to the Canadian proposal. Mexico didn’t find this surprising at all, as it already expected the cold shoulder from their American trade partner on this matter.

In another proposal, Canada made a threat as they claimed that they will keep the right to treat their neighbors worse than other countries if they enter into agreements. One of which could be China. The proposal was obviously not passed, as the US and presumably Mexico considered it ‘unacceptable’.

Although the countries successfully worked towards installing measures against corruption during the round of negotiations, they were far from successful at reaching an agreement on the topic of modifying rules of origin and calculating the regional content of the country in which automobiles are manufactured. All three countries remain motivated to keep making progress and will resume the negotiations for an speculation of two more sessions before the deadline that has been set in March, in order to avoid interference with the presidential election in Mexico and the US midterm elections in November.

Beyond the deadline

After more than seven months of meetings, as we have seen in the round-by-round examination, the negotiations between the three countries still have not reached the pre-agreement threshold that, even waiting to resolve more or less important points, should confirm the shared will to give continuity to NAFTA. The hard positions of the United States and the pressure of Canada and Mexico to save the treaty have so far resulted in a 'tug-of-war' that has allowed some partial, but not decisive, result. Thus, it remains to be determined if the treaty has actually reached its expiration date or may be reissued instead. For the time being, the three countries agree to continue working towards a renewed treaty.

From what has been seen so far in the negotiations, it is difficult to determine which country will be more willing to give in to the pressure exerted by the others. The most controversial issues have barely been addressed until recently, so it is also not possible to point out what achievements each country achieves in this negotiating process.

The two neighbors of the United States, but especially Canada, continue to warn of Trump's risk to end the treaty. An acceleration of the negotiations could help the positive resolution of the process, but the electoral calendar rather threatens delays. On March 30 begins the campaign of the presidential elections in Mexico, which will take place on July 1. In September, the United States will begin to pay more attention to the November Mid-term elections. A substantial progress before the Mexican elections could put the agreement on track, although some issues should have to be agreed later, but if in the next meetings there is not a breakthrough, the three countries could get used to the possibility of ending NAFTA, what would harm the negotiations.

The neighbors of the United States in the Western Hemisphere find it difficult to interpret the first year of the new administration

Donald Trump reaches his first anniversary as president of the United States having caused some recent fires in Latin America. His rude disregard for El Salvador and Haiti, due to the high figures of refugees sheltered in the U.S., and his harsh treatment of Colombia, for the increase in cocaine production, had damaged the relations. Although they were already complicated in the case of Mexico, throughout the year they had some good times, such as the presidents' dinner that Trump summoned in September in New York in which a united action was drawn on Venezuela.

▲Trump in his first 100 days as president [White House]

ARTICLE / Garhem O. Padilla [Spanish version]

One year after the inauguration of the 45th President of the United States of America, Donald John Trump (the ceremony was on January 20), the controversy dominates the balance of the new administration, both in his domestic as well as international performance. The continental neighbors of the United States, in particular, show bewilderment about Trump's policies towards the hemisphere. On the one hand, they regret the American disinterest in commitments of economic development and multilateral integration; on the other hand, they note some activity in relation to some regional problems, such as the Venezuelan one. The actual balance is mixed, although there is unanimity that the language and many of Trump's forms threaten relationships.

From the TPP to NAFTA

In the economic field, the Trump era started with the definitive withdrawal of the United States from the Trans-Pacific Strategic Economic Partnership Agreement (TPP), on January 23, 2017. This made it impossible to enter into force since the United States is the market through which above all, this agreement emerged. The U.S. withdrawal affected the perspectives of the Latin American countries participating in the initiative.

Then, the renegotiation of the North American Free Trade Agreement (NAFTA), demanded by Trump, was opened. The doubts about the future of the NAFTA, signed in 1994 and that Trump has described as "disaster", have stood out in what is going of the administration. Some of its demands, which Mexico and Canada oppose, are to increase the share of products manufactured in the United States, and the "sunset" clause, which would force the treaty to be reviewed methodically every five years and suspend it if any of its three members did not agree. All this, arises from the idea of the U.S. president to suspend the treaty if it is not favorable for his country.

Cuba and Venezuela

If the quarrels with Mexico have not yet reached to an end, in the case of Cuba, Trump has already retaliated against the Castro regime, with the expulsion in October of 15 Cuban diplomats from the Cuban Embassy in Washington in response to "the sonic attacks" that affected 24 U.S. diplomats on the island. The White House, in addition, has revoked some conciliatory measures of the Obama administration because the Castro regime is not responding with open-ended concessions.

As far as Venezuela is concerned, Trump has made strong efforts in terms of introducing measures and sanctions against corrupt officials, in addition to addressing the political situation with other countries, so that they support those efforts aimed at eradicating the Venezuelan crisis, thus generating multilateralism between American countries. However, this policy has detractors, who believe that the sanctions are not intended to achieve a long-term objective, and it is not clear how they would promote Venezuelan stability.

Although in those actions on Cuba and Venezuela Trump has alluded to the democratic principles violated by the governors of Havana and Caracas, his administration has not insisted especially on the commitment to human rights, democracy and moral values, as being usual in the argumentation of the U.S. foreign policy. Some critics point out that the Trump administration is willing to promote human rights only when they meet its political objectives.

This could explain the worsening of the opinion that exists in Latin America about the United States and about the relations with that country. According to the Latinobarómetro survey 2017, the favorable opinion has fallen to 67%, seven points below that at the end of the Obama administration, which was 74%. This survey shows a significant difference for Mexico, one of the countries that, without a doubt, has the worst levels of favorable opinion towards the Trump administration: in 2017 it was 48%, which means a fall of 29 points in comparison with 2016, in which it was 77%.

|

Immigration, withdrawal, decline

The restrictive immigration policies applied would also explain that rejection of the Trump administration by Latin American public opinion. In the immigration section the most recent is the decision not to renew the authorization to stay in the United States of thousands of Salvadorans and Haitians, who once entered the U.S. fleeing calamities in their countries.

We must also allude to Trump's efforts to achieve one of its main objectives since the beginning of his political campaign: to build a border wall with Mexico. The U.S. president has not had much success at this time, since although he has looked for ways to finance it, what he has managed to introduce in the budgets is very insignificant in relation to the estimated costs.

Trump's protectionism entails a withdrawal that may be accentuating the decline of the U.S. leadership in Latin America, especially against other powers. China has been increasing its economic and political performance in countries such as Argentina, Brazil, Chile, Peru and Venezuela. Russia, for its part, has strengthened diplomatic and security relations with Cuba. It could be said that, taking advantage of the conflicts between Cuba and the United States, Moscow has tried to keep the island in its orbit through a series of investments.

Threats to security

This leads us to mention the new National Security Strategy of the United States, announced in December. The document presented by Trump addresses the rivalry with China and Russia, and also refers to the challenge posed by the regimes of Cuba and Venezuela, by the supposed threats to security they represent and the support of Russia they receive. Trump expressed great desire to see Cuba and Venezuela join "shared freedom and prosperity" and called for "isolating governments that refuse to act as responsible partners in advancing hemispheric peace and prosperity."

Similarly, the new U.S. Security Strategy refers to other challenges in the region, such as transnational criminal organizations, which impede the stability of Central American countries, especially Honduras, Guatemala and El Salvador. All in all, the document only dedicates one page to Latin America, in line with Washington's traditional attention given to the areas of the world that most affect their interests and security.

An opportunity for the United States to approach the Latin American countries will be the Summit of the Americas, which will be held next March in Lima. However, nothing is predictable given the characteristic attitude of the president, which leaves a large open space for possible surprises.