Did the increased use of electrical vehicles impact the household’s demand for electricity? In the following text there will be a thorough analysis to answer the question. First of all, a background is necessary to understand the impact of electrical vehicles on the population demographics and what type of consumers were most interested in the purchase. Afterwards, further research has been procured to explore the differences between charging the electric vehicle privately (home, buildings), in comparison to public spaces (city, rural). From the results of the evaluation, the impacts of electricity vehicles on the US grid will surface, which will allow for a better understanding on whether the hypothesis is correct or incorrect. Lastly, along with further real-life evidence and assumptions, an appropriate conclusion to the hypothesis will be confirmed. More electric cars will require both charging infrastructure and much greater electric-grid capacity. The aim of this analysis is to understand the impact of people now charging their vehicles at home as an increase of the demand of electricity at night for households.

Background

The first crude electric vehicle took place in 1832, developed by Robert Anderson. However, it was not until the 1870’s that electric cars became practical. Centuries later electric vehicles became popular, and in 2020 the total sales of electric cars accounted for 2% of the US population. The most frequently bought car is TESLA model 3, created by CEO Elon Musk who co-founded TESLA.

There are a total of three types of electric vehicles available, the first one being BEV, battery electric vehicles, which are 100% powered by electricity. Moreover, there is PHEVs, plug-in hybrid electric vehicles, which are vehicles that have both electric battery (recharged by a plug) and a combustion engine, and lastly, hybrid, which also have both electric battery and a combustion engine, although the electric battery is recharged by using the combustion engine.

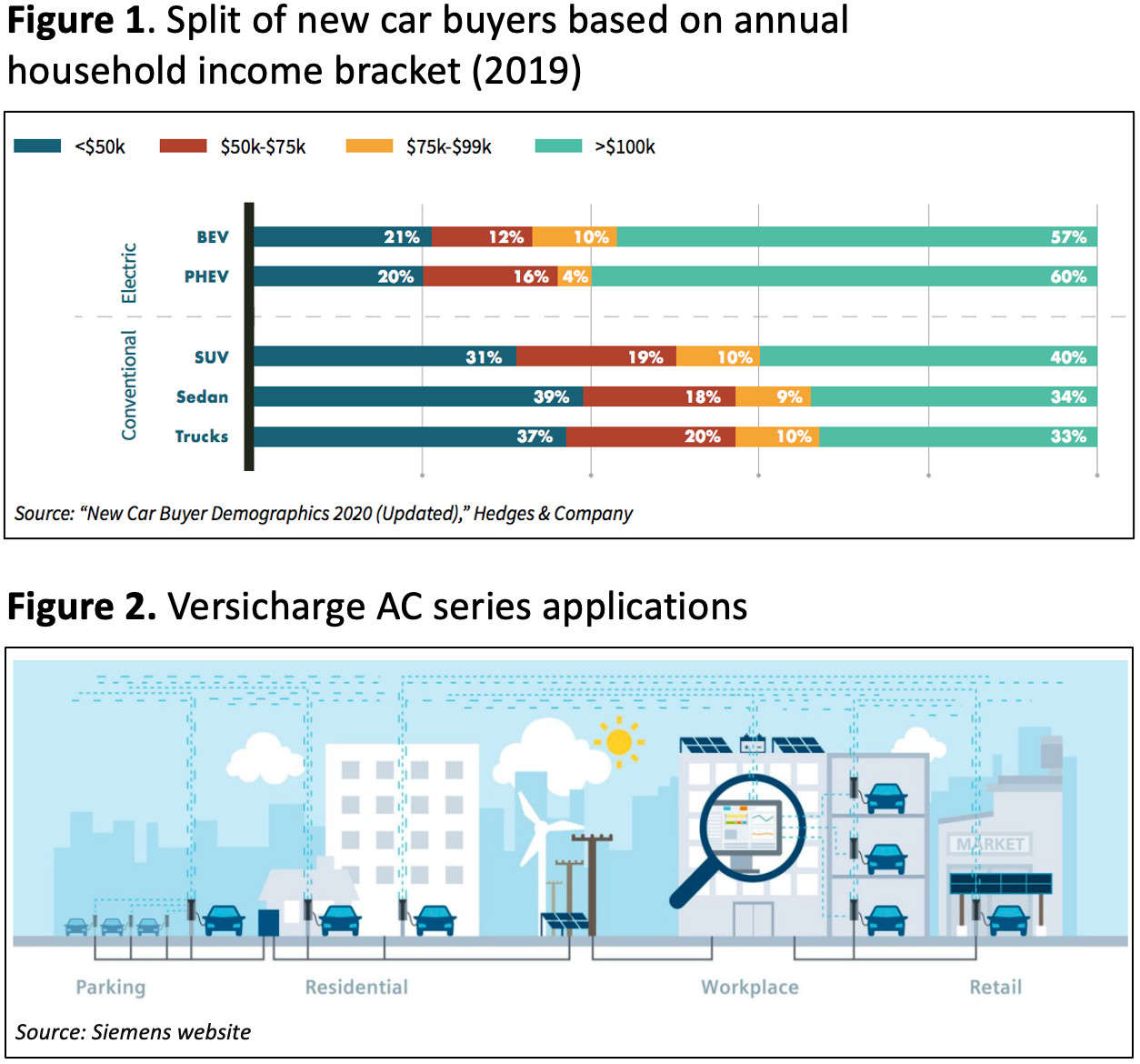

As time passed, electric vehicles sales have exponentially increased and the main factors to take in consideration in the demographics of the typical electric vehicle consumer are the household income, family size, age, driving distance, and geographical location. In 2019, it has been recorded that the top demographic of electric vehicle owners are middle aged white men with a yearly income of more than $100,000. In comparison, combustion engine vehicles consumers have an evenly distributed income that begins less than $50,000 to greater than $100,000 (Figure 1).

However, as time continues to go on, and income is growing, more consumers tend to turn their backs on conventional vehicles and prefer to have a more sustainable lifestyle which leads to higher demand for electric cars. Such results cause an interest in understanding whether the impact on the consumption of electricity has increased overtime. Many electric vehicles need to be plugged into an electricity source in order for them to work, and naturally, just as people do with their phones, it would mean most consumers charge their vehicles at night time, which explains the increase in the peak demand of electricity.