En la imagen

Itaipu dam, a binational hydropower facility owned by Brazil and Paraguay in the Parana River [Herr Stahlhoefer]

As the global arena adamantly scours for new resources, methods and instrumental technologies to combat the energy demand crisis, renewable energy sources present themselves as a sustainable and increasingly attainable solution. Developing economies such as those located in Latin America are beginning to harness the economic and electric potential behind their rich topographical environment in order to fulfill their respective energy requirements.

Ever since the start of the 2000’s Latin America and the Caribbean has become a proactive promoter of renewable energy. In 2020 the renewable energy capacity for the region neared 280 gigawatts (GW) which represents a growth of more than 60% when compared to the start of the decade. Its wind capacity stands at 34 GW, while its solar photovoltaic capacity stands at 21 GW. In 2019 the installed power capacity in Latin America surpassed 400 GW, an increase of almost 50% in comparison to 2010. Nevertheless, it is crucial to denote that despite the geographical proclivity regarding the diversification of the renewable energy market, hydropower has seized the clear victory within the region. In 2020, alone the hydropower capacity in Latin America and the Caribbean amounted to around 200 GW, representing a 30% increase in comparison to 2010.

This analysis will primarily examine the proliferation of hydropower in the region, as well as the challenges it poses. Then, the text will proceed to detect the support policies introduced by Latin American nations in order to promote the diversification of the renewable energy market, as well as consolidate their hydropower capacity. Finally, it will reveal the tax legislation reforms concerning renewable energy in the area.

Hydropower, the main renewable source

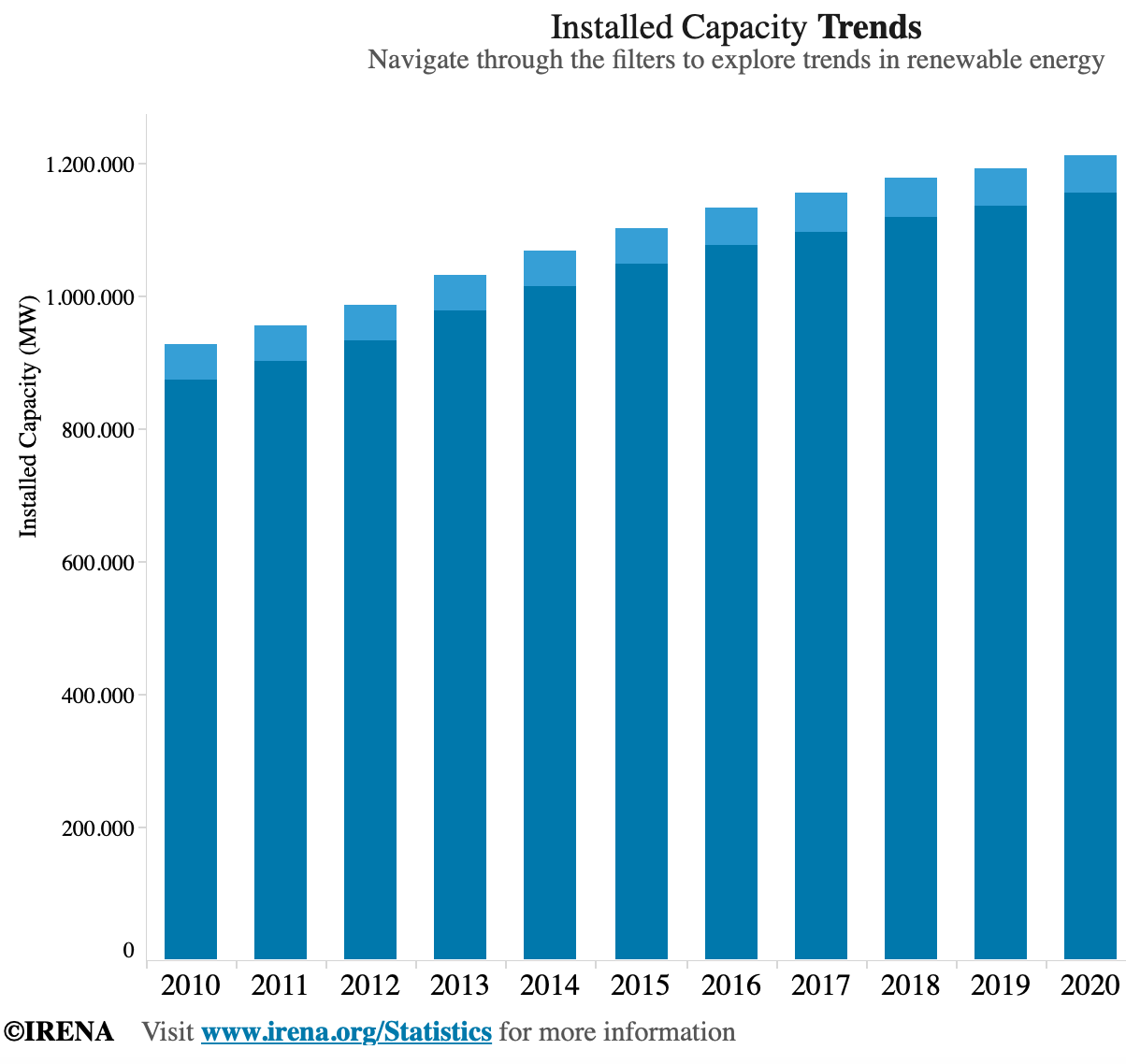

Hydropower is the most widely utilized renewable power source in the world. The global hydroelectric installed capacity which exceeds 1,295 GW, accounting for more than 18% of the world’s total installed power generation capacity and more than 54% of the global renewable power generation capacity. Hydropower has as well a sheer dominance within the energy market of Latin America, representing 45% of the total electricity supply for the region, with an installed capacity of 196 GW in 2019.

South America, with an installed capacity of 176 GW, entailed the fastest hydropower growth rate after the East Asia and Pacific region in 2019; in 2020 Brazil surpassed China with 4,919 MW of added capacity. This impressive fact is attributable to the inauguration of the 11,233 MW Belo Monte hydropower plant, which will provide electricity to 60 million people, positioning itself as the fourth largest in the world. Nevertheless, Brazil’s hydropower superiority relies on the Itaipu hydroelectric dam, the largest hydroelectric asset in the world. On the other hand, Chile possesses almost 16 GW and Argentina almost 22 GW of hydropower potential. Additionally, in Colombia the Ituango hydropower plant is expected to start operating in 2021, as it is bound to support 17% of the country’s energy demand. Furthermore, within the scope of Peru’s plan to become energetically self-sufficient by 2040, a couple of power plants are expected to enter into operations within the next few years.

Crucially, it is imperative to denote that the successful dissemination of hydropower within Latin America is largely due to its geographical positioning and the fluvial availability offered by a plurality of rivers. The major basins are located east of the Andes, with the main rivers flowing towards the Atlantic Ocean. Additionally, the four largest drainage systems comprising the Amazon, La Plata, Orinoco, and Sao Francisco rivers, cover about two-thirds of the continent.

Nonetheless, hydropower does not constitute an infallible energy source, as climate change may generate negative repercussions for it, whilst creating a necessity for the diversification of the renewable energy market. Climate projections assign an escalation in the variability of extreme precipitation events, which translate into unpredictable floods, droughts, and heavy rainfall by the end of this century. The latter, presents itself as a paramount threat towards hydropower as the unpredictability of extreme precipitation events will “increase risks to hydropower generation by altering water availability, increasing sediments or causing physical damages to government subsidized assets”. In addition to the spatial variation in precipitation patterns, Central America, Mexico, Chile, and Argentina are forecasted to experience a concise reduction in precipitation in the coming century, which would inevitably be detrimental for hydropower.

Besides the imminent threat of climate change, the subject concerning aging hydro plants raises concerns about the viability of hydropower. The standard lifespan of a hydropower plant or dam is 30-80 years, a digit which has been already surpassed in some countries such as Mexico and Peru, where the average technical lifespan of a hydropower facility is estimated to be between 81-104 years for the latter. In fact, over 50% of the installed capacity within Latin America is stated to be over 30 years old (6). Hence, due to the limited availability of capital in the region, and the intensification of environmental constraints regarding construction permits, it is likely that lifespan expiration of hydropower facilities becomes a standard practice in Latin America.

Policies to boost renewable energy: auctions

The IEA World Energy Outlook projects that, due to the development of other renewable sources, the share of hydropower would stay globally at its current level. In the case of Latin America, as result of both climate change and aging hydropower facilities, hydropower capacity will most probably decrease within the next decade. Consequently, governments within the region will need to establish novel legislative proposals that promote the diversification of renewable energy sources and the conservation of hydropower against the adversities of climate change.

Ever since the usage of renewable resources became economically viable for Latin American countries, the implementation of support policies has become a common-place practice within the state agencies of the Latin American nations. According to a Pfeiffer and Mulder’s 2013 Study of 108 developing economies, the likelihood of investing in renewable energies is 30% higher in countries with support policies. Now, due to the cost gap between conventional sources (such as fossil fuels) and renewable energy, investments in the latter have relied on the implementation of price-based and quantity-based support policies.

Price-based initiatives consist of feed-in tariffs (FITS) that set a fixed price at which the renewable energy could be sold, ensuring a return on investment in a stable predictable framework. On the other hand, quantity-based policies rely on renewable energy auctions or ‘demand auctions’, whereby the government basically issues a call for ‘tenders to install a certain capacity of renewable energy-based electricity’. Within these types of auctions project developers will submit a bid with a price per unit of electricity at which they are able to realize the project, the government will then evaluate the offers and proceed to sign a purchasing agreement with the successful bidder. Upon this exposition, the Pfeiffer and Mulder study determined that since 2012 the auction system has consolidated itself as the main policy instrument characteristic of the region with generally positive results.

Actually, by 2017 10 countries in the region had implemented at least one type of renewable auction policy. The dominance of auctions in the region partially relies on the sub-performance of feed-in tariffs in Latin America, as the few countries that have applied such a policy have endured relatively poor results. For example, in 1998-2006 the public policy based on feed-in premium in Argentine failed to advocate for renewable energy sources which were affected by an ‘unfavorable macroeconomic and regulatory context’.

Moreover, the application of the auctions has propelled the renewable energy market within the region, providing sufficient intelligence to distinctly identify five advantages of the auction system. According to German Bersalli, Philippe Menanteau and Jonathan El-Methni the auction system i) provides a stable revenue system that facilitates project funding, ii) stimulates competition amongst producers in order to facilitate the externalization of the costs concerning renewable energy, iii) renders itself adaptable to technologies with varying degrees of techno-economic maturity, iv) allows the introduction of other selection criteria that may support national public policy such as job creation, v) finally and most importantly, the auction system ensues itself as a perfect fit with the institutional design of the electric system in most Latin American countries. Hence, due to the authoritative nature of the previously mentioned assertions, their legitimacy shall now be corroborated with concrete case study from various Latin American countries.